States with the Lowest Tax Burden on Small Businesses (2023)

From Wyoming to Tennessee, these are the states with the lowest tax burdens on small businesses.

Small businesses contribute significantly to job creation, innovation, and community development. In fact, they account for around 44% of U.S. economic activity and have historically generated about two-thirds of all new jobs[1]. While many factors influence their growth and trajectory, the tax environment in each state represents a significant element of this complex equation.

High taxes provide necessary revenue for public services but can also pose challenges for small businesses. They may limit reinvestment opportunities, constrain hiring, and threaten business survival. As a result, some businesses may struggle to maintain a healthy bottom line, which in turn can lead to downsizing, stagnation, or even closure.

On the other hand, low taxes can help to facilitate business growth. They leave more resources for businesses to invest in innovation, workforce, and development. Lower taxes can enhance profitability, foster economic prosperity, and encourage entrepreneurial initiatives. This fiscal freedom can fuel a virtuous cycle of prosperity that benefits not just businesses but the communities and economies they serve.

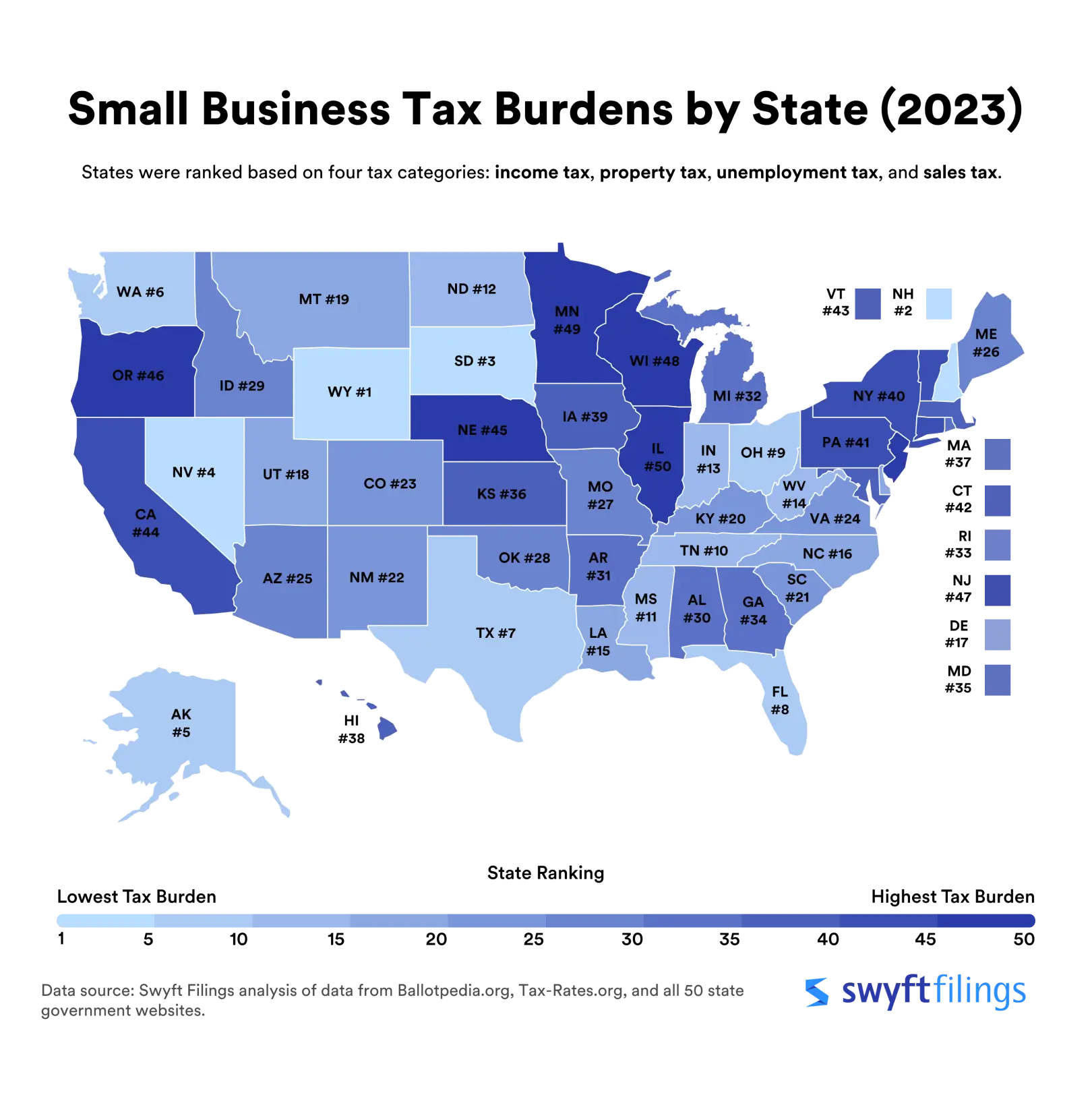

The data and research team at Swyft Filings analyzed the most recent data to identify the states with the lowest tax burden on small businesses. They evaluated tax structures in each state based on a variety of factors, including corporate and individual tax rates, the sales tax on both a state and local level, property taxes, and unemployment insurance taxes, each of which contributes to the overall tax burden borne by small businesses.

Tax Burden by State on Small Businesses (2023)

State | Overall Rank | Total Score | Income Tax | Property Tax | Unemployment Tax | Sales Tax |

|---|---|---|---|---|---|---|

WY | 1 | 84.64 | 1 | 10 | 9 | 16 |

NH | 2 | 80.95 | 11 | 49 | 27 | 1 |

SD | 3 | 77.48 | 1 | 35 | 17 | 21 |

NV | 4 | 75.34 | 4 | 23 | 43 | 34 |

AK | 5 | 72.28 | 6 | 30 | 48 | 5 |

WA | 6 | 71.17 | 5 | 28 | 42 | 44 |

TX | 7 | 69.79 | 1 | 48 | 21 | 38 |

FL | 8 | 68.64 | 8 | 29 | 16 | 22 |

OH | 9 | 65.32 | 7 | 40 | 30 | 32 |

TN | 10 | 62.83 | 10 | 13 | 25 | 46 |

MS | 11 | 59.26 | 25 | 7 | 3 | 26 |

ND | 12 | 58.78 | 9 | 41 | 49 | 28 |

IN | 13 | 58.78 | 12 | 24 | 23 | 23 |

WV | 14 | 58.66 | 26 | 5 | 5 | 14 |

LA | 15 | 58.20 | 18 | 2 | 1 | 49 |

NC | 16 | 58.18 | 13 | 20 | 10 | 33 |

DE | 17 | 57.26 | 48 | 4 | 8 | 1 |

UT | 18 | 56.40 | 23 | 11 | 14 | 25 |

MT | 19 | 56.26 | 45 | 21 | 7 | 1 |

KY | 20 | 55.66 | 20 | 15 | 29 | 10 |

SC | 21 | 54.98 | 32 | 6 | 2 | 31 |

NM | 22 | 53.70 | 27 | 9 | 12 | 35 |

CO | 23 | 52.59 | 15 | 11 | 33 | 43 |

VA | 24 | 51.79 | 38 | 17 | 15 | 9 |

AZ | 25 | 51.70 | 16 | 15 | 36 | 40 |

ME | 26 | 50.31 | 34 | 33 | 13 | 7 |

MO | 27 | 50.22 | 21 | 27 | 20 | 42 |

OK | 28 | 50.08 | 17 | 17 | 26 | 48 |

ID | 29 | 49.51 | 39 | 14 | 32 | 13 |

AL | 30 | 49.16 | 35 | 1 | 28 | 49 |

AR | 31 | 48.52 | 30 | 7 | 39 | 45 |

MI | 32 | 47.29 | 24 | 44 | 35 | 10 |

RI | 33 | 47.26 | 28 | 38 | 31 | 23 |

GA | 34 | 46.91 | 37 | 21 | 22 | 36 |

MD | 35 | 46.74 | 42 | 25 | 34 | 10 |

KS | 36 | 46.33 | 19 | 36 | 24 | 41 |

MA | 37 | 46.01 | 44 | 30 | 18 | 17 |

HI | 38 | 45.27 | 46 | 3 | 50 | 6 |

IA | 39 | 44.11 | 40 | 36 | 19 | 27 |

NY | 40 | 43.90 | 22 | 34 | 37 | 47 |

PA | 41 | 43.61 | 31 | 38 | 47 | 19 |

CT | 42 | 43.33 | 33 | 42 | 41 | 18 |

VT | 43 | 43.28 | 41 | 43 | 6 | 15 |

CA | 44 | 42.84 | 47 | 17 | 40 | 37 |

NE | 45 | 42.54 | 36 | 46 | 4 | 30 |

OR | 46 | 42.35 | 50 | 25 | 45 | 1 |

NJ | 47 | 40.91 | 29 | 50 | 46 | 20 |

WI | 48 | 39.14 | 43 | 46 | 38 | 8 |

MN | 49 | 34.67 | 49 | 32 | 11 | 29 |

IL | 50 | 29.91 | 14 | 45 | 44 | 39 |

Key Takeaways

National averages: Small businesses face an array of taxes that impact their bottom line. On average, across the United States, the state sales tax rate is 5.07%, supplemented by a local sales tax rate typically imposed at the county or city level, averaging an additional 1.33%. The burden of personal property tax on small businesses averages 0.98%. As for income tax, the average effective rate for individuals (the rate paid by sole proprietors and “pass-through” entities) stands at 3.95%, while corporations are taxed at a slightly higher average rate of 5.23%. Lastly, the average unemployment tax is at 4.14%. If a state did not levy a tax for any of these categories, the tax rate for that state was factored into the national average as 0%.

Regional differences: Regional disparities in tax burdens faced by small businesses in the United States are evident when comparing average composite scores by region. The West leads the pack with an average score of 58.00, indicating a relatively lower tax burden on businesses. Trailing closely behind, the South offers a business-friendly tax environment with an average score of 56.04. The Midwest, while not as tax-advantageous, still presents a moderate average score of 49.55. However, businesses in the Northeast face the highest tax burden on average, as reflected in the region's average score of 48.84.

Methodology

To determine the state with the lowest tax burden on small businesses in 2023, the data and research team at Swyft Filings ranked each state using a composite score of factors across four key tax categories: income tax, property tax, unemployment tax, and sales tax. Below are the four categories and their percentage of the composite score.

Note: Rather than marginal tax rates, effective tax rates were used to score states, as they provide a clearer picture of the actual tax burden imposed. Income (individual and corporate) tax rates were calculated based on the annual median revenue of a U.S. small business of $78,000[2].

Income tax: 50% of composite score

Individual income tax rate[3]

Corporate income tax rate[3]

Property tax: 15% of composite score

Median property tax rate[4]

Unemployment tax: 15% of composite score

Sales tax: 20% of composite score

States with the Lowest Tax Burdens on Small Businesses (2023)

10. Tennessee

Individual income tax rate: None

Corporate income tax rate: 6.50%

State sales tax rate: 7.00%

Average local sales tax rate: 2.45%

Start your business the right way by obtaining your federal tax ID EIN so you can open bank accounts, collect revenue, and hire new employees.

9. Ohio

Individual income tax rate: 2.49%

Corporate income tax rate: None%

State sales tax rate: 5.75%

Average local sales tax rate: 1.35%

8. Florida

Individual income tax rate: None

Corporate income tax rate: 5.50%

State sales tax rate: 6.00%

Average local sales tax rate: 0.65%

Ensure you hit all of your filing deadlines, remain compliant, and maintain your privacy with the support of our registered agent services.

7. Texas

Individual income tax rate: None

Corporate income tax rate: None (the corporate tax threshold in Texas is $1.23 million)

State sales tax rate: 6.25%

Average local sales tax rate: 1.80%

6. Washington

Individual income tax rate: None

Corporate income tax rate equivalent: 0.85%

State sales tax rate: 6.50%

Average local sales tax rate: 2.39%

It can take as little as 10 minutes to start an LLC online with Swyft Filings. Our experienced business specialists can help you save time and money while forming your LLC.

5. Alaska

Individual income tax rate: None

Corporate income tax rate: 4.00%

State sales tax rate: None

Average local sales tax rate: 1.76%

4. Nevada

Individual income tax rate: None

Corporate income tax rate: None

State sales tax rate: 6.85%

Average local sales tax rate: 1.30%

3. South Dakota

Individual income tax rate: None

Corporate income tax rate: None

State sales tax rate: 4.00%

Average local sales tax rate: 1.83%

2. New Hampshire

Individual income tax rate: None

Corporate income tax rate: None (the corporate tax threshold in New Hampshire is $103,000)

State sales tax rate: None

Average local sales tax rate: None

1. Wyoming

Individual income tax rate: None

Corporate income tax rate: None

State sales tax rate: 4.00%

Average local sales tax rate: 1.83%

Bibliography

U.S. Small Business Administration. "Small Businesses Generate 44 Percent Of U.S. Economic Activity." Accessed June 28, 2023.

PaymentsJournal. “What's the Annual Median Revenue of a US Small Business?.” Accessed June 27, 2023.

Individual state government websites for all 50 states. Accessed June 27, 2023.

Tax-Rates.org“Property Taxes By State.”Accessed June 27, 2023.

Ballotpedia. “State Unemployment Tax.” Accessed June 27, 2023.

Tax-Rates.org. “2023 Local Sales Taxes By State.” Accessed June 27, 2023.

All charts, statistics, and findings on this page are free to use. We kindly request that you attribute any full or partial use to Swyft Filings with a link to this page. Thank you!

Swyft Blog

Everything you need to know about starting your business.

Each and every one of our customers is assigned a personal Business Specialist. You have their direct phone number and email. Have questions? Just call your personal Business Specialist. No need to wait in a pool of phone calls.