Obtain Your FREE Federal Tax ID (EIN)

Before your business collects revenue, open a bank account, or hire employees, you will need an Employer Identification Number (EIN), or what is referred to as a Federal Tax ID number. This nine-digit number is essentially the social security number for your business. Our reliable and experienced business professionals can obtain your EIN for you completely free.

EIN Filing: How it Works

Our automated EIN filing process, backed by our professional expertise, makes it easy.

When you get an EIN number with us, we make it easy to stay in compliance. In most cases, all it takes is a few clicks of your mouse.

Why You Should Obtain an EIN Number with Swyft Filings

Our knowledgeable staff has years of experience in EIN obtainment and other types of filings for customers of all sizes. Do what you love; let us handle the paperwork.

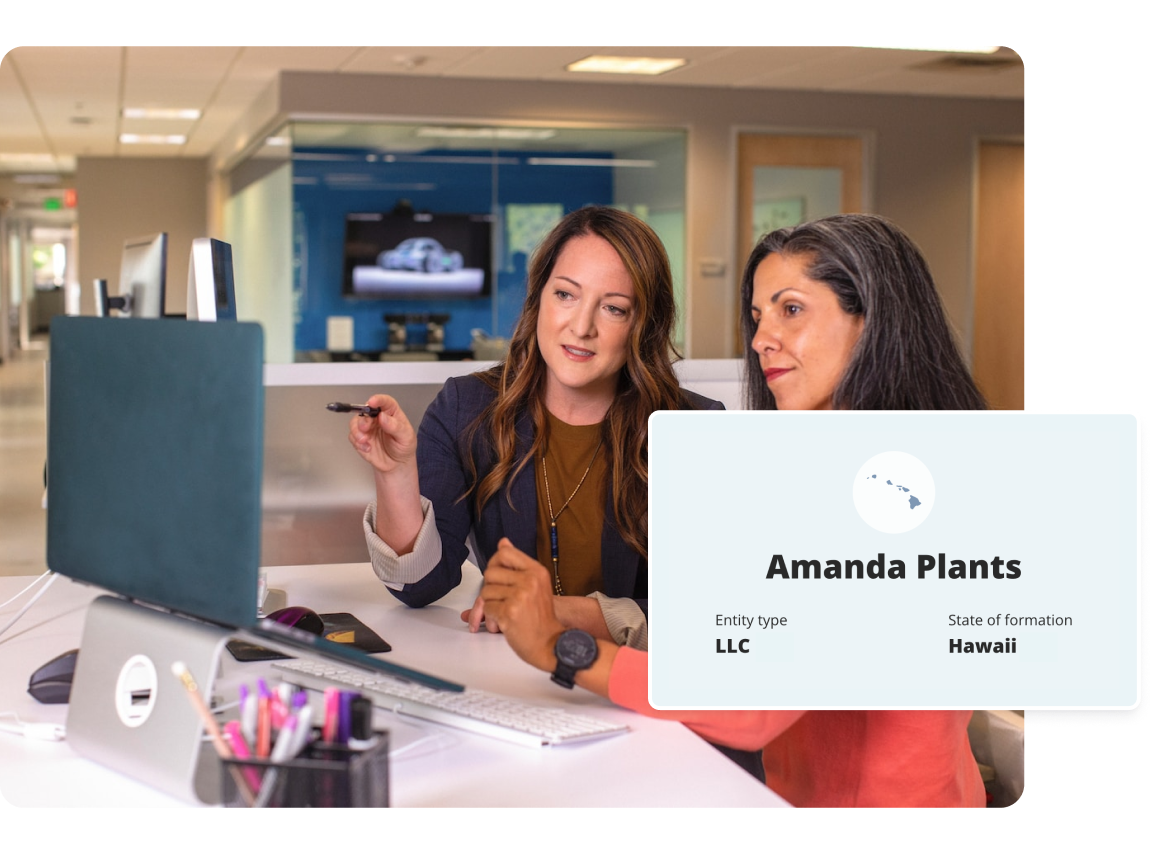

Experienced Professionals

Swyft Filings has helped thousands of customers obtain an EIN. We can put all of that expertise and knowledge to work for you so you can get back to focusing on your business.

Fast & Reliable Service

Through your secure online account, you can usually complete the process with just a few clicks of your mouse. Let our EIN services experts take over from there. With our automated process and expertise, we do it fast and do it right.

Avoid the Headaches

Rather than doing the research and figuring out exactly how to fill out and file the paperwork yourself, let our professionals apply for a federal tax ID number for you. Our mission is to take away the hassles of paperwork so you can instead focus on building your business.

Stay in Compliance

There is a lot you cannot do until you obtain an EIN. Additionally, messing up this annoying administrative task can slow you down and cost you extra. Knowing that filing for an EIN will be done fast and done right the first time allows you to get to work faster and follow your passion while we take care of the paperwork.

Testimonials

We Take Care of Business, Your Business

• 300,000+ businesses created since 2015

• 36,000+ five-star reviews

• Personalized customer service specific to your needs

Filing for an EIN: FAQs

Still have questions? Call 877-777-0450 or Live Chat with us for real-time support.

An Employer Identification Number (EIN) is a special nine-digit number the IRS gives to businesses. With it, you can hire employees, open bank accounts, and ensure your business is tax-ready.

Aside from some sole proprietorships, almost every business requires an EIN just to function. Your business needs an EIN to:

Hire employees

Open a business bank account

File your taxes

Pay independent contractors

Even for sole proprietorships, using an EIN can also help keep your SSN secure.

You'll usually only need a new EIN if your business structure or management changes. For other changes, like a new business name, you might have other paperwork, but your EIN stays the same.

EIN/Federal Tax ID Resources

Interested in learning more about your Federal Tax ID and what it means for your business? Learn this and more in Swyft’s Resource Center.

Do what you love. We'll handle the paperwork.

Trusted by over 300,000 businesses since 2015. Start your business with confidence. Affordable. Fast. Simple.